IND Technology: Investment Notes

Summary We’re pleased to announce our investment in IND Technology, a Melbourne-headquartered grid-tech company pioneering early fault detection for transmission

Stay up to date with

Virescent Ventures news

Summary We’re pleased to announce our investment in IND Technology, a Melbourne-headquartered grid-tech company pioneering early fault detection for transmission

Summary We are excited to announce our investment in NRN, a Sydney-based business that provides rooftop solar and batteries to

Summary We are excited to announce our investment in Amber, Australia’s most popular energy retailer for home battery owners. For

Virescent Ventures, Australia’s largest and most active climate tech VC fund, has today confirmed a substantial equity investment in National

Summary We are excited to announce our investment in Kwetta, a New Zealand-based business commercialising a novel solution for ultra-fast

Queensland Investment Corporation (QIC) has been announced as a major investor in Virescent Ventures’ second climate technology fund (Fund II),

Australia’s largest and most active dedicated climate tech VC, Virescent Ventures has completed a $100 million first close of its

Blair Pritchard is a Partner at Virescent Ventures and has led Virescent’s Seed, Series A and Series B investments in

Summary We are excited to announce our investment in Xefco, a Geelong-based start-up that has developed a novel technology for

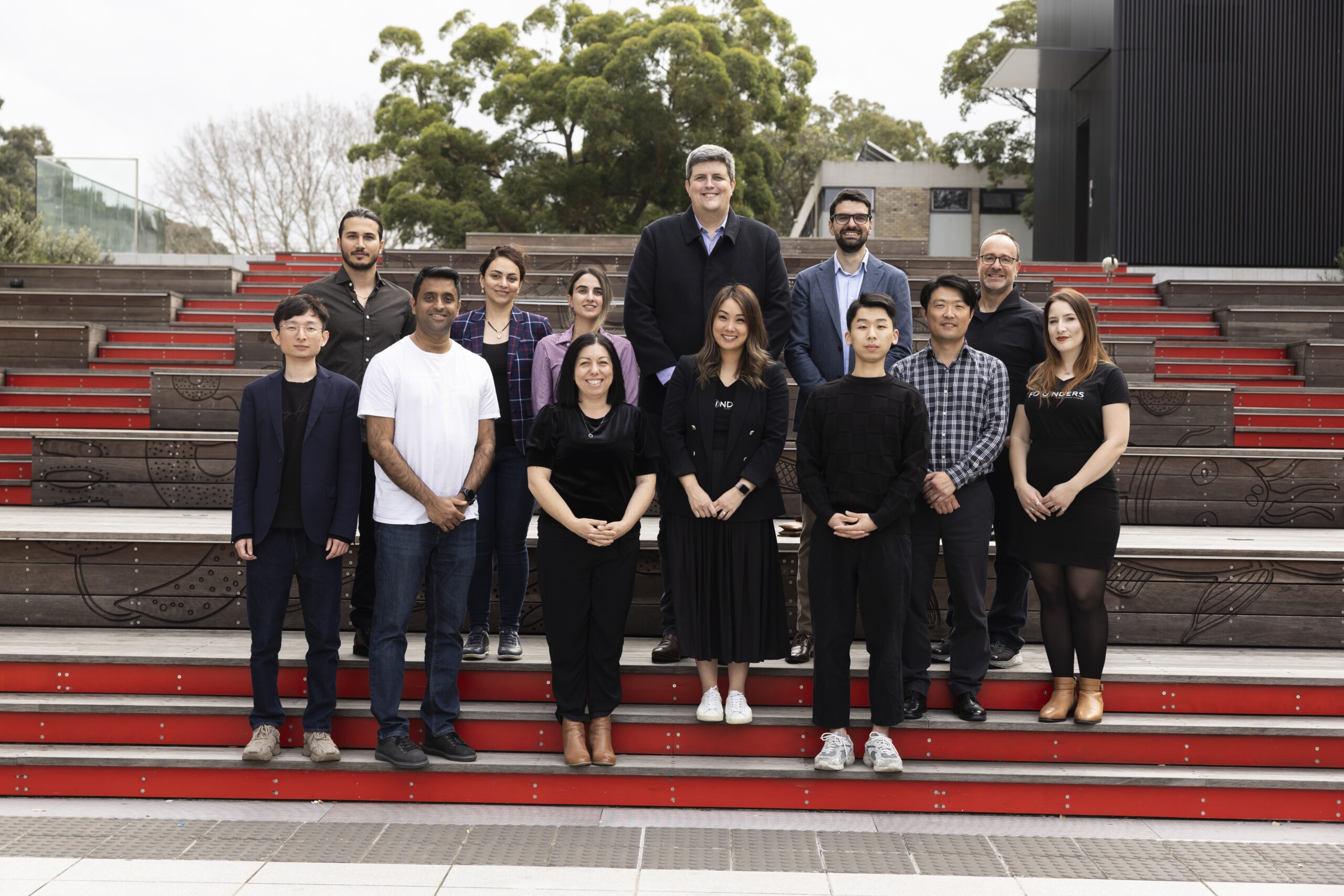

The Trailblazer for Recycling & Clean Energy and Virescent Ventures back UNSW Founders’ Climate 10x accelerator program The Trailblazer for

Virescent Ventures has announced that they have deployed over $260m in capital into 33 Australian climate tech startups. Established in

Australian battery recycling startup Renewable Metals has closed an $8 million investment round to scale and commercialise its groundbreaking lithium-ion

Virescent Ventures has backed HydGene Renewables, a new Australian company that has developed an alternative green hydrogen solution that turns

Virescent Ventures portfolio company Novalith Technologies has announced their A$23m Series A to build a processing plant that uses their

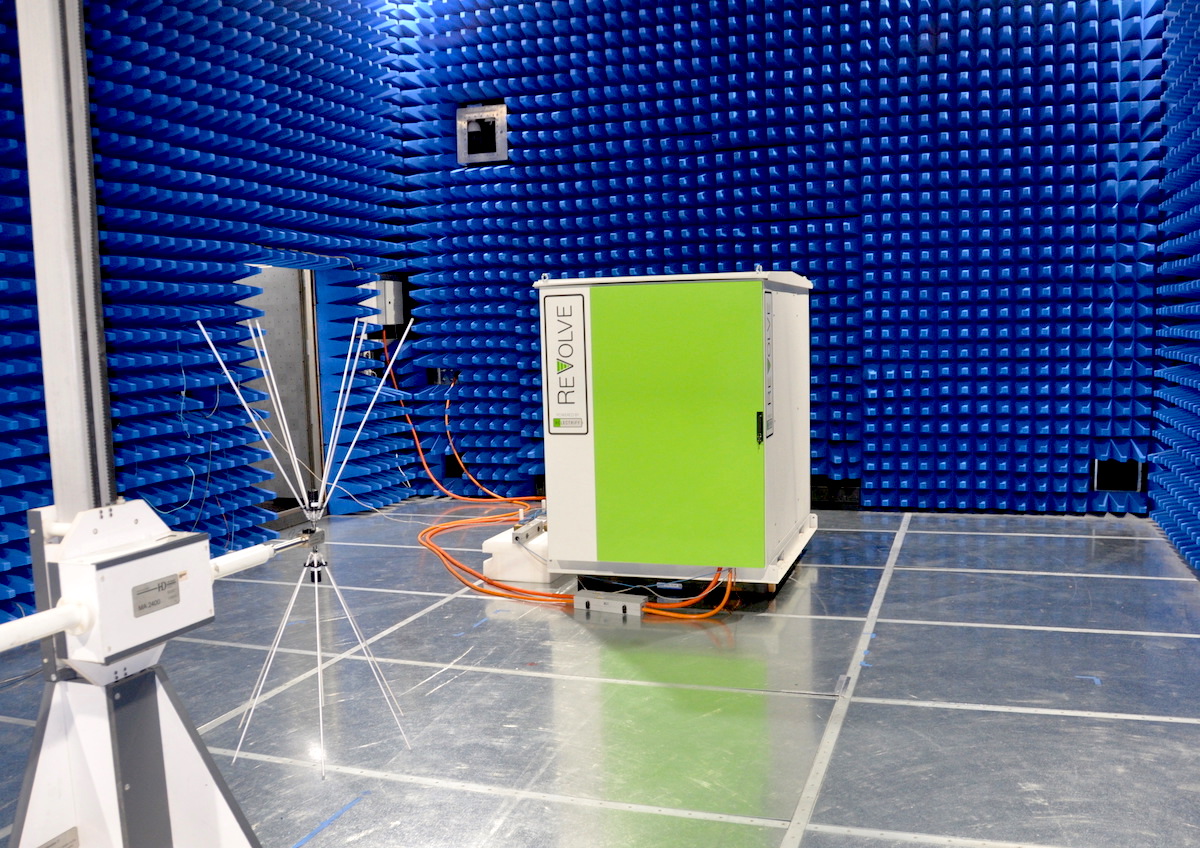

Virescent Ventures portfolio company Relectrify today announced the ReVolve® energy storage product, featuring its patented cell-level control technology, has achieved

Virescent Ventures portfolio company, Loam Bio, is launching into the Australian market after years of product development and its latest